STAC Summit, 14 May 2024, New York

STAC Summits bring together CTOs and other industry leaders responsible for solution architecture, infrastructure engineering, application development, machine learning/deep learning engineering, data engineering, and operational intelligence to discuss important technical challenges in trading and investment.

Agenda

Click on the session titles to view the slides and video.

STAC Update: AI |

|

|

Jack will provide a preliminary look into STAC-AI™, an LLM benchmark suite guided by the priorities of financial firms, which measures a full solution stack -- from the model to the metal™ |

Temporal RAG: Enabling GenAI breakthroughs in trade ideation, execution, and risk management |

|

|

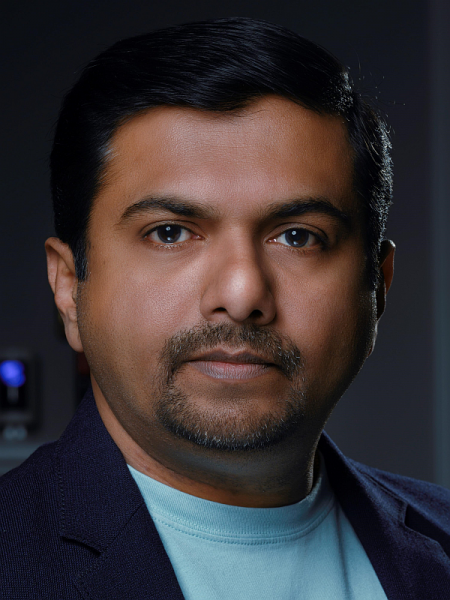

Getting large language models (LLMs) to provide accurate and relevant output is a well-known challenge. It’s even more daunting in the fast-moving landscape of capital markets. Trading and investment firms care deeply about the sequence of events and how information changes over time. The key to unleashing the power of GenAI for markets is to integrate source content into a timeseries framework and to enable LLMs to operate on the wealth of traditional financial timeseries that firms already amass. Through practical, high-impact use cases in alpha gen, trade execution, and risk, Conor will argue for a new kind of retrieval augmented generation (RAG) that fully leverages the temporal properties of information. |

Doing GenAI at scale this year |

|

|

Most financial firms experimented with LLMs in 2023. Some have solutions in production, and those who don't are mostly planning to in 2024. Once an initial solution is in production, AI architects will face the consequence of their success: demand for more users and use cases. But scaling generative AI is more complicated than usual. With more use cases come broader model governance challenges. LLM instances can be in short supply, scattered geographically, and diverse in capability. And fixed or variable costs can be "eye watering" (as one hedge fund described their first bills for AI inference). Fortunately, every few days the research and vendor communities supply new models, software, hardware, managed services, and design patterns to tackle these problems. Which of these have the most promise and will be practical in 2024? And what kind of architectural frameworks are best in a world of such rapid change? Our panel of experts will dig into these questions and yours. |

STAC update: Tick analytics  |

|

|

Jack will present the latest Council activities and benchmark results for deep time-series analytics. |

STAC update: Risk computing  |

|

|

Jack will present the latest Council activities and benchmark results involving derivatives risk computation. |

Surfing the gravity wells: Risk & trading analytics in an AI- and hyperscaler-dominated tech universe  |

|

|

Banks and hedge funds require more compute, storage, and networking to meet increasing demands for trading and risk analytics. Data volumes continue to balloon, regulations require more simulations, and new market opportunities require new analytics. However, generative AI and cloud have famously become "gravity wells" for the IT industry, driving its product roadmaps. On the one hand, this may increase the options available for financial HPC and data-intensive workloads, driving down long-term costs. On the other hand, AI and hyperscaler architectures can differ in important ways from those of today's trading and risk analytics, which presents challenges. To what extent can the finance industry benefit from the new products coming forth? How much longevity is left in existing approaches? Are there opportunities (or even imperatives) for trading and investment firms to rethink how they design their applications and infrastructure? |

STAC Update - Fast Data & Compute   |

|

|

Jack will discuss the latest Council activities and test results relating to 1) low-latency LSTM inference on market data and 2) network stacks in the cloud and on the ground. |

Big distances, tiny tolerances: Making time sync precise over a wide area |

|

|

Building a time-synchronization network spanning multiple data centers within a metropolitan area is a formidable challenge, particularly when the requirements include fault tolerance, nanosecond accuracy, and traceability to UTC(NIST). Quincy Data undertook this challenge, using White Rabbit in Chicago and New Jersey to synchronize across the major trading venues and using GNSS to connect these metros into a single clock domain. Come to hear Mike explain some of the problems Quincy encountered in design and implementation and how they overcame them. |

Staying cool at speed: Adding 25G to HFT accelerators |

|

|

Supporting 25G Ethernet can reduce the latency of FPGA or ASIC algorithms--but only if it is implemented well. Signal integrity, power, and thermal challenges exist all the way from the 25G IP, through the package, and across the PCB. In this talk, Lawrence will explore these challenges and present methods to analyze and resolve them so that you can achieve cool speed with 25G. |

Threading the needle: Navigating constraints to compete in real time |

|

|

To stay in the game, trading firms must manage ever-growing data rates and keep their architectures competitive, whether it’s making software faster or hardware smarter. But mounting requirements for regulation, compliance, and cyber are straining resources. Meanwhile, finding well-trained talent is only getting harder. What are the best strategies to navigate these constraints? What are the best buy/hold/sell strategies for technologies across the spectrum, from FPGA and ASIC to private clouds? Where does it make sense to buy third-party logic today? Our panel of experts will weigh in. |

About STAC Events & Meetings

STAC events bring together CTOs and other industry leaders responsible for solution architecture, infrastructure engineering, application development, machine learning/deep learning engineering, data engineering, and operational intelligence to discuss important technical challenges in financial services.

|

|

|

|---|---|---|

Event Resources

Speakers

Dino VitaleTD Securities

Dino VitaleTD Securities Eric PowersCiti, STAC Fellow

Eric PowersCiti, STAC Fellow

Daniel WisehartCubist Systematic Strategies

Daniel WisehartCubist Systematic Strategies Ivan KunyankinDevexperts

Ivan KunyankinDevexperts

Conor TwomeyKX

Conor TwomeyKX Bob GainesIntel Corporation

Bob GainesIntel Corporation

Troy KasterPenguin Solutions

Troy KasterPenguin Solutions Attila NarinOracle

Attila NarinOracle

Matthew KlosIBM

Matthew KlosIBM Phil AronowitzDDN

Phil AronowitzDDN

Matt CertosimoAMD

Matt CertosimoAMD Scott CaudellGoogle

Scott CaudellGoogle

Louis LiuShengli Technologies

Louis LiuShengli Technologies David BechtoldIBM

David BechtoldIBM

Sanjay BasuOracle

Sanjay BasuOracle Michael WatsonSupermicro

Michael WatsonSupermicro

Mike SchonbergQuincy Data

Mike SchonbergQuincy Data Lawrence DerCadence

Lawrence DerCadence

Michael McGuirkAMD

Michael McGuirkAMD Amol ChoukekarDell Technologies

Amol ChoukekarDell Technologies

Bernie MalouinJETCOOL Technologies

Bernie MalouinJETCOOL Technologies Robert GlanzmanPure Storage

Robert GlanzmanPure Storage

Bill BodeiHammerspace

Bill BodeiHammerspace Liz CorriganMyrtle.ai

Liz CorriganMyrtle.ai

Nate BradacAdaptive

Nate BradacAdaptive Sebastian JugRed Hat

Sebastian JugRed Hat

James LuptonBlackcore Technologies

James LuptonBlackcore Technologies Tom CoombsOrthogone

Tom CoombsOrthogone

Mike GalimeKeysight

Mike GalimeKeysight Aaron FooFMAD Engineering

Aaron FooFMAD Engineering

Dan EdmundsOptions Technology

Dan EdmundsOptions Technology Vahan SardaryanLDA Technologies

Vahan SardaryanLDA Technologies

Seth FriedmanLiquid-Markets-Holdings

Seth FriedmanLiquid-Markets-Holdings Cliff MaddoxNovaSparks

Cliff MaddoxNovaSparks Olivier CousinExegy

Olivier CousinExegy Jack GiddingSTAC

Jack GiddingSTAC